1. Select a REALTOR and establish a relationship

We are full-time, professional REALTORS with extensive market knowledge. We will work closely together with you to find your new home. For more information about our qualifications and why we may be the best fit for you, see the OUR TEAM section of this package.

2. Meet for an initial consultation

During our initial consultation, we will meet with you to establish your motivations and objectives for buying. We will discuss your needs, analyze your resources and concerns, and determine what loan type will work best for you. We have many lenders we work with regularly and recommend. Ask us for a referral, or check out www.GingerMatney.com for the most current list of recommended professionals. Once we have determined your motivations and objectives, we will do all the necessary research to guide you through the process of finding an ideal home and location.

3. Identify property to buy through daily alerts

We will set you up with the MATRIX MLS service that will email you daily or immediately with new listings that meet your criteria. This means every time something new hits the market, we’ll know RIGHT AWAY! It’s your job to let us know when you see something you want to view in person.

The more precise and direct you are with us, the more successful we will be in accomplishing your goals, so please tell us EVERYTHING you think may might be helpful.

4. Determine the seller’s motivation and review buyer due diligence

Once we have found the home you wish to purchase, we will do all the necessary research to help you structure an effective offer. This is part of what we refer to as the due diligence (DD) process. There is an example of DD at the end of this section.

Showing you the home is the easy part; figuring out how to get it for you at the best possible price and terms is where our work begins!

Sample Due Diligence:

Click here to download a Sample Full Report or Sample Mini-Report.

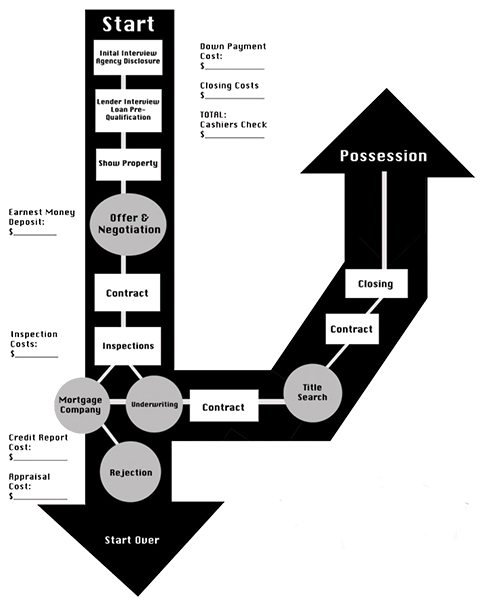

5. Write an offer to purchase and pay earnest money

We will draft the purchase agreement for you, advise you on protective contingencies, customary practices, and local regulations. At this time you will need to provide an “earnest money” deposit, usually 1-3% of the purchase price. The earnest money deposit is not cashed until after the seller accepts your offer. You will receive this money back as a credit toward your down payment at the time of closing. See more information on the next few pages under “When Do You Pay Your Money?”

We will present your offer to the seller’s agent. The seller then has three options: they can accept your offer, counter your offer, or reject your offer. We will advise you of any circumstances we are aware of, such as the occurrence of multiple offers, and give you choices on how to handle each situation we encounter. You are in charge at this point; we are simply here to guide you through the process and help you negotiate the best deal possible for the current market.

6. Sellers response

Our negotiating skills and experience will greatly benefit you in reaching an optimum final agreement with the seller. We review all responses to your offers and work closely with the other agent to determine seller objectives. This enables us to develop a win-win agreement, which has the best likelihood of being accepted by the seller and working well for you.

7. Notify title company

When the purchase agreement is accepted and signed by all parties, we will contact the title company for you and provide them with the contract. At this time, your earnest money will be deposited with them.

8. Contingency period

This is the period of time where our work really ramps up! We will advise you in advance of multiple deadlines and give you the details necessary to make decisions. For example, you will likely have 7-10 days to perform all inspections and you will have nearly 30 days for your loan and appraisal. It’s our job to watch these dates and deadlines and ensure that you are proceeding as agreed per contract. The contract is complex, and this is part of why it’s good to hire a professional REALTOR who knows the contract inside and out. See “Our Promise to You” under “When Do You Pay Your Money?” on the following pages.

9. Closing

We will coordinate between you, the seller’s agent, and the closing agent/title company. We will make sure that all documents are in order and that you fully understand every part of the transaction prior to signing any closing documents and completing the purchase of your home. At this time, you will pay the remainder of your down payment and closing costs.

You can expect closing to take a couple of hours. You will need to let us know in advance if you are not going to be in town during your closing date so that we can make alternative arrangements, such as signing in advance or creating a POA (Power of Attorney).

Additionally, we can provide you copies of your entire transaction in either paper or electronic form. At the end of your closing, you will leave a homeowner, with keys in hand!